Irs lump sum pension calculation

Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you. Pension VS Lump Sum Calculator.

Cash Balance Pension Plans Selected Legal Issues Everycrsreport Com

Ad Get Started With Our Free Online Chat - It Only Takes Three Minutes and is Easy to Use.

. When that happens you only. This is a total lifetime limit even if lump sums are taken at different times. In the US the most popular defined-contribution DC plans are the 401 k IRA and Roth IRA.

The tax free amount of Eileens retirement lump sum is calculated by adding the basic exemption plus the difference between the SCSB and the basic exemption. Severance pay is taxed as per the Lump Sum Retirement Benefits tax table. Find out what the required annual.

Calculation of Taxable portion of Lump Sum Pension. Currently a maximum of 200000 can be taken as a tax free pension lump sum. Ad Trade with the Power of thinkorswim When You Roll Over Your 401k Into an IRA.

Ad We Manage Your Retirement Account So You Dont Have To. To calculate your percentage take your monthly pension amount and multiply it by 12 then divide that total by the lump sum. In fact up to 25 of the value of your pension can be taken tax-free and our handy calculator will help you to estimate the balance between lump sum and annual pension thats.

You will pay taxes on your lump-sum payout. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 2021-22 and 2022-23 tax years.

Please click here to view the Calculation of Taxable portion of Lump sum pension. Get The Flexibility Visibility To Spend W Confidence. When youre 55 or older you can.

Tax on lump sums at retirement. Begin Saving For Your Retirement Today - Your Future Self Will Thank You. DC plans are now the most popular pension plans in the US especially in the private sector.

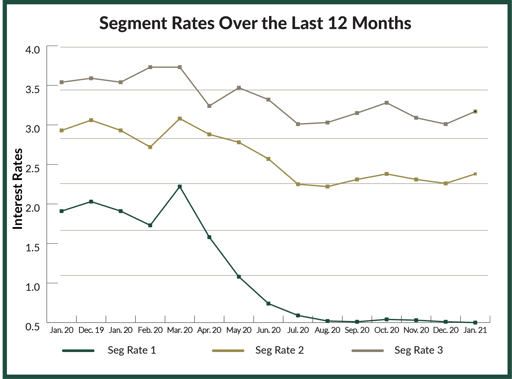

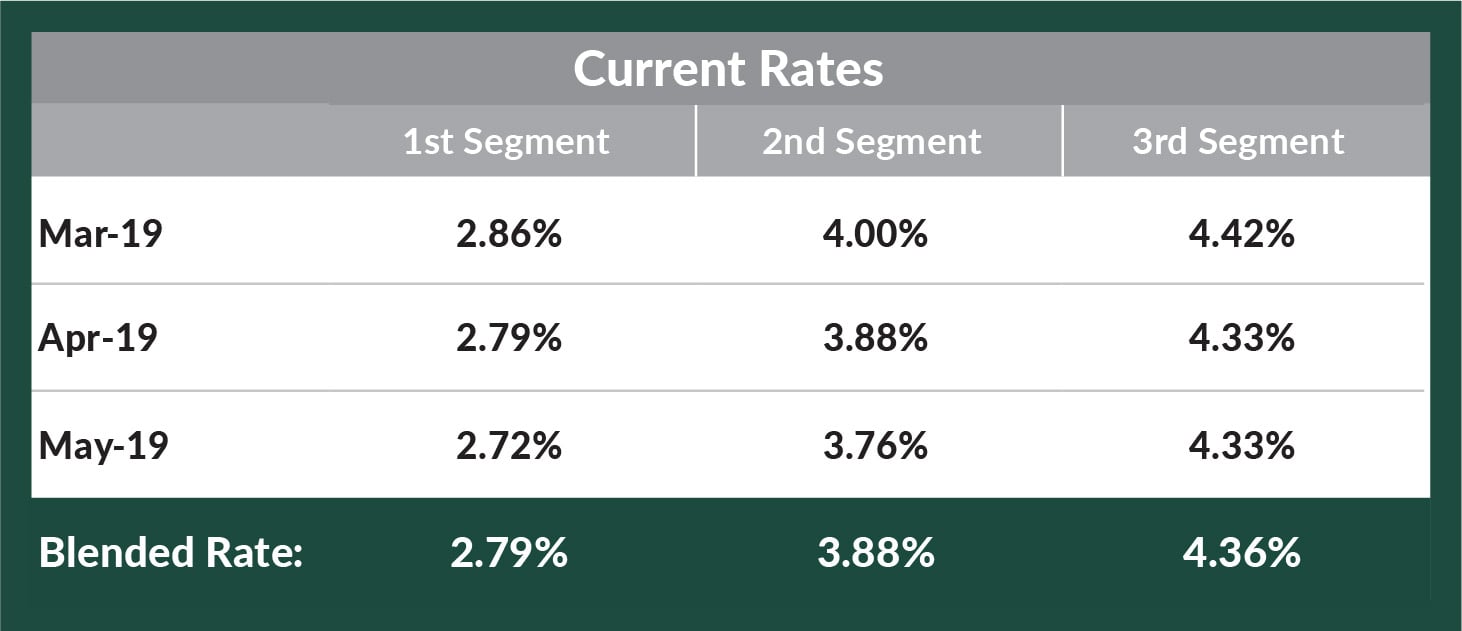

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. The 30-Year Treasury rate has been rising this year but is still lower than the historical average of 479. If you want the full amount of your lump sum pension invested in your retirement account youll.

Access Schwab Professionals 247. T001 table in sap. There are different regulations around how your pension provider will initially apply tax on your pension lump sum dependent on the size of your pension savings and whether you have.

Ad Could increased liquidity give you more control over your 500K in retirement savings. Your lump sum money is generally treated as ordinary income for the year you receive it rollovers dont count. We have the SARS tax rates tables.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. This could mean your pension lump sum would be higher than. Ad We Manage Your Retirement Account So You Dont Have To.

See What Account Is Right For You. How is lump sum pension payout calculated. This amount forms part of an individuals lifetime tax-free purge valve gmc acadia 9mm ar.

You will pay taxes on your lump-sum payout. Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 2021-22 and 2022-23 tax years. Readers with particularly long memories will recall that last year the state of Illinois instituted a lump sum cashout program in which in order to reduce its pension liabilities it.

A simplified illustration. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. Use this calculator to compare the results of getting a lump sum payout instead of a guaranteed monthly pension for life.

See What Account Is Right For You. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. This pension appraisal calculator is also useful for people who need to know todays cash value of their pension in order to make a decision about a lump sum buyout offer from a pension.

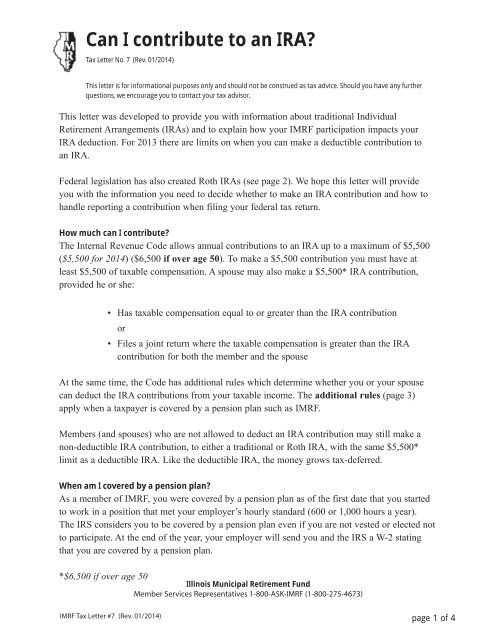

Tax Letter No 7 Can I Contribute To An Ira Imrf

Taxes On An Early Pension Buyout

2

How To Pick Your Retirement Date To Optimize Your Chevron Pension

How To Pick Your Retirement Date To Optimize Your Chevron Pension

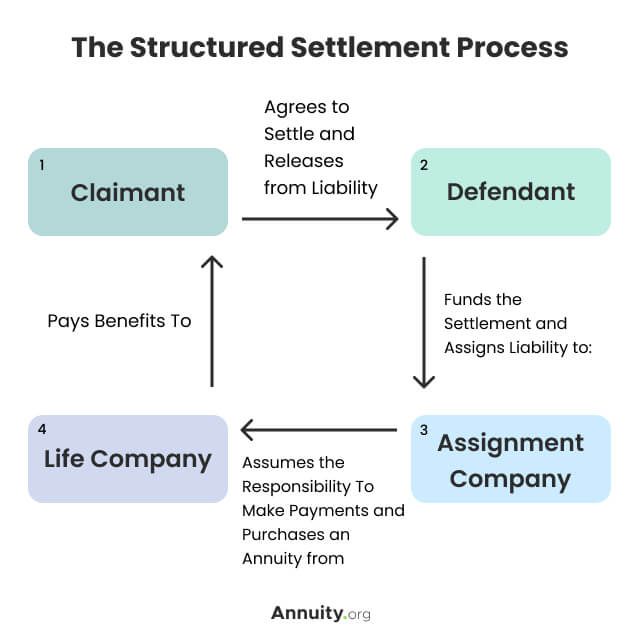

What Is A Structured Settlement And How Do They Work

How Taxes Can Affect Your Social Security Benefits Vanguard

How To Pick Your Retirement Date To Optimize Your Chevron Pension

Pers Plan 3 Department Of Retirement Systems

2

How To Pick Your Retirement Date To Optimize Your Chevron Pension

How Taxes Can Affect Your Social Security Benefits Vanguard

Pers Plan 3 Department Of Retirement Systems

Lump Sum Vs Lifetime Monthly Payments What Should I Do With My Pension Ramseysolutions Com

Instructions For Form 990 Pf 2021 Internal Revenue Service

2

Xwtf2rthoh0ihm